It does not correspond to any user ID in the web application and does not store any personally identifiable information. The cookie is used by cdn services like CloudFlare to identify individual clients behind a shared IP address and apply security settings on a per-client basis. These cookies ensure basic functionalities and security features of the website, anonymously. Necessary cookies are absolutely essential for the website to function properly. Fiscal Policy – discretionary stabilisers.This is known as discretionary fiscal policy. Keynes argued that automatic stabilisers may not be enough, and the government should specifically find public sector projects to inject money into the circular flow. This is why Keynes advocated government borrowing – to make use of these surplus savings. Therefore, we see a rise in private savings and a fall in aggregate demand. Keynes noted that in a recession, confidence falls and the private sector cut back on spending and investment. In 2009, there was a small fiscal expansion – higher government spending, e.g.Without these tax cuts, government borrowing would have been even lower in 2003. In 2003, the Bush administration passed generous tax cuts – reducing the rate of income tax.In the recession, with falling GDP, the government deficit increases sharply. In periods of positive economic growth – we see low levels of annual government borrowing. Also, sales tax revenues will fall as people spend less. Tax receipts fall – due to people earning lower incomes. Also, with higher growth, there will be a rise in income tax receipts and corporation tax receipts – this helps to limit the growth rate. In periods of high economic growth – government spending on unemployment benefits will fall – causing an improvement in government finances. In a recession – ceteris paribus government borrowing will increase.Įxample of Automatic Stabilisers in US economy.This increase in benefit spending and lower tax collection helps to limit the fall in aggregate demand. With lower incomes, people pay less tax, and government spending on unemployment benefits will increase.

However, automatic stabilisers will help to limit the fall in growth. In a recession, economic growth becomes negative.

With higher growth, there will also be a fall in unemployment so the government will spend less on unemployment benefits. With higher growth, the government will receive more tax revenues – people earn more and so pay more income tax (note the tax rate doesn’t change, the amount received just becomes higher). High Growth – In a period of high economic growth, automatic stabilisers will help to reduce the growth rate.Automatic stabilisers will influence the size of government borrowing.

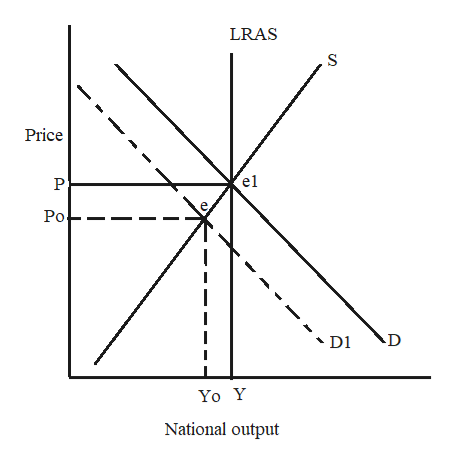

Automatic stabilisers refer to how fiscal instruments will influence the rate of growth and help counter swings in the economic cycle.

0 kommentar(er)

0 kommentar(er)